Core Modules

- Computing for Finance - C++: MATH70112 (P. Bilokon)

- Computing for Finance- Python: MATH70112 (A. Muguruza & J. Jacquier)

- Fundamentals of Option Pricing Theory: MATH70107 (H. Zheng)

- Interest Rate Models: MATH70111 (D. Brigo & Y. Zhang)

- Quantitative Risk Management: MATH70110 (H. Zheng & A. Coache)

- Simulation Methods: MATH70113 (Y. Zhang)

- Statistical Methods: MATH70108 (T. Cass)

- Stochastic Processes: MATH70109 (E. Neuman)

Computing for Finance - C++: MATH70112 (P. Bilokon)

Computing for Finance- Python: MATH70112 (A. Muguruza & J. Jacquier)

Fundamentals of Option Pricing Theory: MATH70107 (H. Zheng)

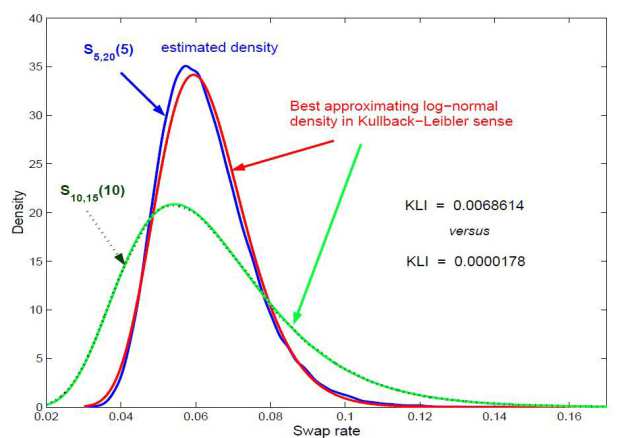

Interest Rate Models: MATH70111 (D. Brigo & Y. Zhang)

Quantitative Risk Management: MATH70110 (H. Zheng & A. Coache)

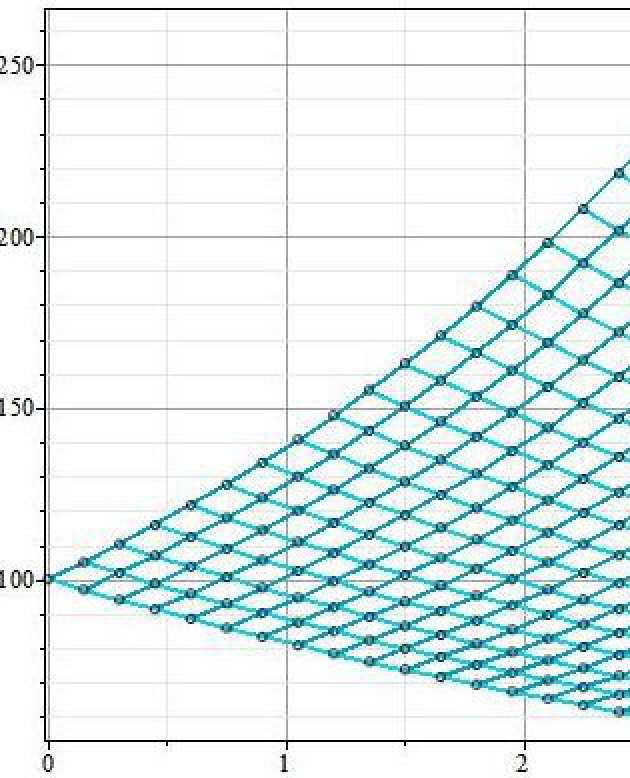

Simulation Methods: MATH70113 (Y. Zhang)

Statistical Methods: MATH70108 (T. Cass)

Stochastic Processes: MATH70109 (E. Neuman)

Scholarships

Please visit our webpage for scholarships information.

MSc Maths Finance News

- Msc Mathematics and Finance ranks 1st in the 2024 QuantNet Ranking of Best UK Quant Programs

- MSc Mathematics and Finance ranks 5 highest UK-based programme in the 2022 Quant Guide

Congratulations!

- Ranitea Gobrait for receiving the JP Morgan Scholarship New J.P. Morgan Scholarship creates Quantitative Finance study opportunities | Imperial News | Imperial College London

- Cécilia Auburn (Class of 2020) for the award of First laureate of the "CFM Women in quantitative finance" grant.

Terms and conditions

Important information that you need to be aware of both prior to becoming a student, and during your studies at Imperial College:

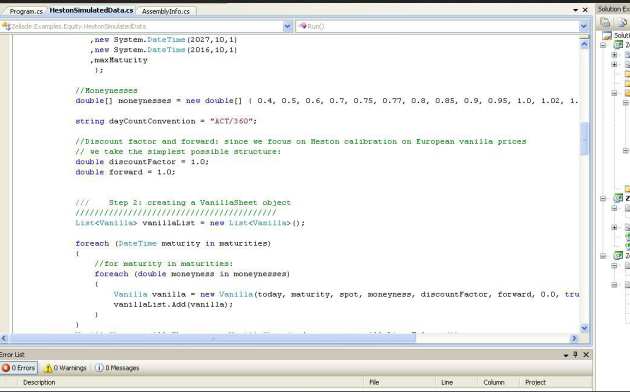

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates.

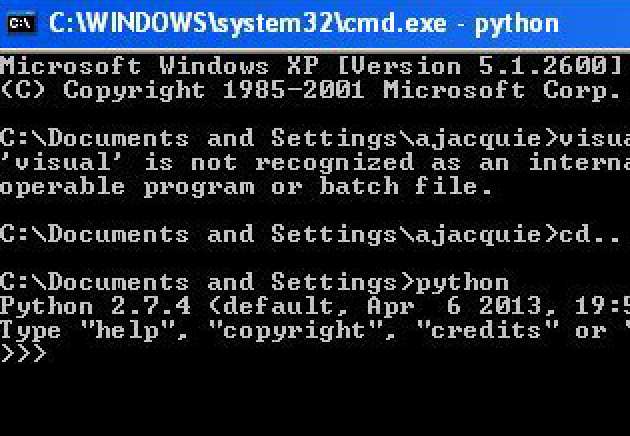

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates. This module is part of Computing in Finance and will give an introduction to the Python programming language. Attending this course is a prerequisite to Computig in Finance - C++

This module is part of Computing in Finance and will give an introduction to the Python programming language. Attending this course is a prerequisite to Computig in Finance - C++ This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course

This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course

The financial industry has changed dramatically over the past few years, and the new regulations imposed to banks require more statistical knowledge. The aim of this new core module is to reflect these changes, and to make students up to date with the current needs of the financial sector. This course is concerned with essential statistical methods for the analysis of financial data. Topics covered include regression methods (including ordinary and generalised least squares), time series analysis (including ARMA, ARCH, GARCH), Bayesian analysis, parametric estimation methods (including maximum likelihood estimation and classical asymptotic theory), and non-parametric estimation methods. The various methods are illustrated by applications in finance and tests on real data.

The financial industry has changed dramatically over the past few years, and the new regulations imposed to banks require more statistical knowledge. The aim of this new core module is to reflect these changes, and to make students up to date with the current needs of the financial sector. This course is concerned with essential statistical methods for the analysis of financial data. Topics covered include regression methods (including ordinary and generalised least squares), time series analysis (including ARMA, ARCH, GARCH), Bayesian analysis, parametric estimation methods (including maximum likelihood estimation and classical asymptotic theory), and non-parametric estimation methods. The various methods are illustrated by applications in finance and tests on real data.  This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts for random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the martingale property. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochastic differential equations and some references to partial differential equations.

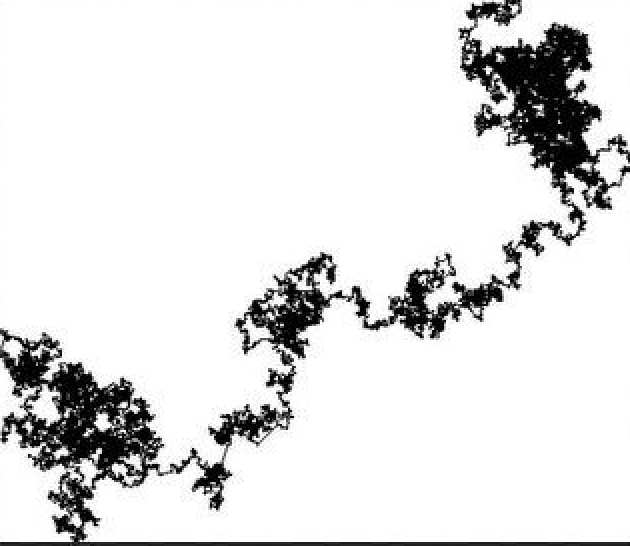

This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts for random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the martingale property. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochastic differential equations and some references to partial differential equations.